In the evolving landscape of the housing market, where a significant portion of the population opts for rental living, the need for renters insurance has never been more pronounced. This guide is crafted for insurance marketers, focusing on leveraging advanced digital marketing strategies to effectively promote renters insurance. We’ll explore the latest trends, statistics, and consumer insights, providing a detailed framework for actionable marketing tactics.

Understanding the Renters Insurance Market

Market Trends and Consumer Insights

The renters insurance market is experiencing significant shifts. According to the National Multifamily Housing Council (NMHC), 36% of the U.S. population lives in rental housing. Despite this, there is a gap in coverage, with only 41% of renters having renters insurance, compared to 95% of homeowners.

The Importance of Digital Engagement

Digital engagement has become a cornerstone in modern insurance marketing. A J.D. Power survey indicates that 74% of insurance customers prefer digital channels for policy management, emphasizing the need for digital marketing strategies.

Targeted Marketing Strategies

Segmenting Your Audience

Effective marketing begins with understanding your audience. Millennials, a large segment of renters, are particularly responsive to digital marketing. Pew Research Center’s report on smartphone ownership shows that 93% of millennials own smartphones, making digital platforms ideal for engagement.

Leveraging Data and Analytics

Data analytics can provide deep insights into customer preferences. Google Analytics, for example, can track website visitor behavior, aiding in the development of tailored marketing strategies.

Digital Marketing Tactics for Renters Insurance

SEO and Content Marketing

SEO and content marketing are vital for online visibility. Creating informative blog posts on topics like “Benefits of Renters Insurance” can attract potential customers. A well-optimized article can rank higher in search engine results, drawing more traffic to your site.

Social Media and Online Advertising

Social media platforms have revolutionized the landscape of digital advertising by offering unparalleled targeting capabilities. Platforms like Facebook and Instagram are particularly effective for insurance marketers due to their sophisticated targeting algorithms and vast user bases.

Facebook Advertising

Facebook’s advertising platform allows marketers to target users based on a wide range of criteria, including age, location, interests, behaviors, and even life events. For instance, insurance marketers can target individuals who have recently moved – a key demographic for renters insurance. By using Facebook’s Lookalike Audiences, marketers can also reach new users who have similar characteristics to their existing customers, thereby expanding their reach to a relevant audience.

Instagram Advertising

Instagram, with its visually-driven platform, is ideal for capturing the attention of younger demographics, such as millennials and Gen Z, who are significant segments within the renters market. Instagram ads can be particularly effective when they feature compelling imagery or short videos that highlight the benefits of renters insurance. For example, a series of Instagram Stories that showcase real-life scenarios where renters insurance could provide protection can be both informative and engaging.

Moreover, Instagram’s integration with Facebook’s advertising platform means that campaigns can be seamlessly managed across both platforms, ensuring consistency in messaging and maximizing reach.

Retargeting Strategies

Retargeting is another powerful tool in social media advertising. This technique involves targeting users who have previously interacted with your content or visited your website but did not complete a conversion action, such as requesting a quote. By displaying retargeted ads on social media platforms, you can remind these potential customers of the benefits of renters insurance, and guide them back to complete the conversion process.

Social media platforms like Facebook and Instagram offer dynamic and effective ways to reach potential renters. By leveraging targeted advertising, engaging content, and retargeting strategies, insurance marketers can significantly enhance their reach and effectiveness in promoting renters insurance.

Email Marketing and Personalization

Email marketing, especially when personalized, can significantly boost engagement. According to Campaign Monitor, emails with personalized subject lines have a 26% higher open rate.

Building Trust and Credibility

Customer Reviews and Testimonials

Customer reviews and testimonials are vital for building trust. Showcasing positive experiences on your website and social media can influence potential customers’ decisions. A compelling customer story can be more persuasive than generic marketing content.

Transparency and Educational Content

Providing clear, educational content about renters insurance can help demystify the product. Infographics and explainer videos that simplify coverage options can be particularly effective in educating potential customers.

Emerging Trends in Renters Insurance Marketing

Influencer Marketing

Leveraging influencers in the insurance sector can be a game-changer. Collaborating with influencers who have a strong following among your target demographic can enhance brand visibility and credibility. Influencers like Tony Cañas and Jean Chatzky, who can provide clear and relevant information, are invaluable. Tony’s approachable style and focus on educating new entrants in the insurance market resonate well with younger renters, while Jean Chatzky’s expertise in personal finance and her ability to address the unique needs of older demographics make her an ideal influencer for mature audiences. Jean’s content, which often covers topics like retirement planning and financial stability, aligns perfectly with the concerns of older renters who prioritize asset protection and comprehensive coverage. The key for insurance companies is to collaborate with influencers who can authentically connect with their target audience, whether it’s young professionals just starting out or older individuals seeking in-depth, reliable financial guidance for their insurance needs.

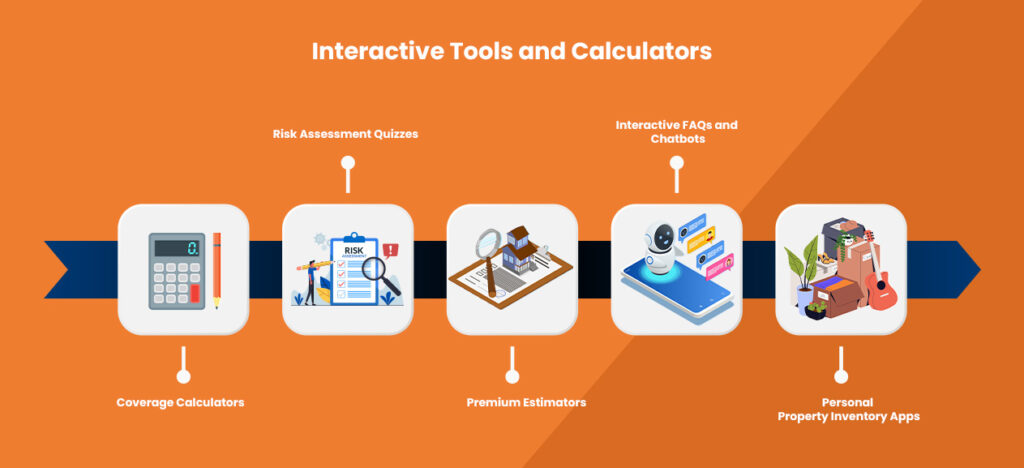

Interactive Tools and Calculators

In the realm of renters insurance, interactive tools and calculators play a pivotal role in engaging potential customers and providing them with personalized insights. These tools make the process of purchasing renters insurance more relatable, accessible, and tailored to individual needs.

1. Renters Insurance Coverage Calculators: These calculators are designed to help renters estimate the amount of coverage they need. By inputting details about their personal belongings, living situation, and specific concerns (like high-value items or additional liability coverage), users can get a clearer picture of the appropriate coverage level. This helps in demystifying insurance terms and empowers renters to make informed decisions about their policy.

2. Risk Assessment Quizzes for Renters: These quizzes guide renters through a series of questions about their rental property, lifestyle, and potential risks (such as proximity to hazards or lifestyle factors that might affect liability). The outcome provides valuable insights into the types of risks they may face as renters and suggests the most suitable insurance coverage options, enhancing their understanding of why certain coverages are recommended.

3. Premium Estimators for Renters Insurance: Premium estimators allow potential customers to get a quick estimate of their insurance premiums based on factors like the value of their personal property, desired coverage levels, and deductible amounts. This level of transparency in pricing is crucial in building trust and helping renters budget for insurance costs.

4. Interactive FAQs and Chatbots: Implementing interactive FAQs and chatbots on insurance websites can significantly improve the customer experience. These tools can answer common questions about renters insurance, guide users through the policy selection process, and provide immediate assistance, making the process of getting insurance less daunting and more user-friendly.

5. Personal Property Inventory Apps: Tools that help renters create and manage an inventory of their personal property can be invaluable in determining coverage needs and in the event of a claim. These apps can guide users to catalog their belongings, estimate their value, and store this information securely, which can be extremely helpful in ensuring adequate coverage and in streamlining the claims process.

By integrating these interactive tools and calculators, insurance providers can offer a more engaging, informative, and user-friendly experience to potential renters insurance customers, ultimately leading to higher satisfaction and better-informed insurance decisions.

Virtual and Augmented Reality Experiences

The integration of Virtual Reality (VR) and Augmented Reality (AR) technologies in renters insurance is an emerging trend, with some insurance companies beginning to explore their potential. While widespread adoption in the US is still in the early stages, these technologies show promise for enhancing customer experience in the insurance sector.

1. Virtual Home Tours for Risk Assessment: Allianz in the UK has pioneered the use of AR for home risk assessment. They created a virtual house where customers can identify potential risks using their mobile devices. This concept could inspire US-based insurers to develop similar VR tools for renters insurance, helping customers understand the importance of adequate coverage.

2. Augmented Reality for Property Inventory: AR technology for property inventory is being explored for its potential to streamline policy selection and claims processing. This could allow renters to easily catalog their belongings and estimate values, a useful tool that insurers might consider implementing.

3. Interactive Policy Exploration with AR: Allianz’s exploration of AR for policy details could set a precedent for insurers. This technology can make insurance policies more accessible and engaging, a promising area for future development in the US market.

4. VR Simulations for Understanding Coverage: The use of VR for customer education about renters insurance coverage is an area ripe for development. Insurers could create VR simulations to help renters visualize different coverage scenarios, enhancing their understanding of policy benefits.

5. AR for Disaster Preparedness: AR technology’s potential application in disaster preparedness for renters insurance is an innovative approach that insurers could adopt. This technology can educate renters on how to protect their homes in emergency situations, enhancing their preparedness.

As VR and AR technologies continue to evolve, we can anticipate gradual adoption by more insurance companies, including those in the US, aiming to enhance customer engagement and education. These tools represent a significant step towards a more interactive and immersive future in insurance technology.

The digital marketing landscape offers a plethora of opportunities for promoting renters insurance. By embracing the latest strategies and technologies, insurance marketers can effectively reach and engage their target audience. Staying updated with market trends and consumer preferences is crucial for developing successful marketing campaigns in this dynamic sector.

Partner with Insurance Inbound

For insurance agencies and professionals looking to enhance their digital marketing strategies, partnering with Insurance Inbound can provide the expertise needed to effectively connect with potential clients. Contact us to learn how we can help you grow your business and effectively market renters insurance in today’s digital world.