In today’s competitive insurance market, customer engagement and retention have become paramount. Yet, many insurers struggle to captivate and educate their clientele effectively in a world where attention spans are at an all-time low. Enter gamification—a dynamic solution that is transforming insurance customer engagement through interactive marketing strategies. This blog explores practical gamification techniques in insurance that can increase loyalty, educate, and engage customers in novel ways.

Understanding Gamification in the Insurance Industry

Gamification applies game-design elements in non-game contexts to improve user engagement, organizational productivity, and learning, using fun and interactive strategies. It’s not just about points and badges; it involves crafting compelling experiences that resonate with users on an emotional and motivational level.

Real-Life Example: Allianz’s Quest for Engagement

Allianz SE, a leading insurer, implemented a gamification program to enhance their customers’ understanding of insurance products and services. Through an online platform, customers could complete educational challenges related to insurance concepts and earn rewards for their participation. The result? A significant increase in customer engagement and satisfaction rates, proving that interactive insurance education can be both fun and beneficial.

Key Gamification Techniques and Their Impact

Leaderboards and Progress Bars: Motivation Boosters

Incorporating elements like leaderboards and progress bars can effectively motivate customers to participate more actively. These tools create a sense of competition and progression that can make the learning process about insurance products feel more like a game and less like a chore.

Badges and Rewards: Recognizing Achievements

Badges serve as a powerful tool for recognition and motivation. They reward customers for their achievements and encourage continued engagement. For instance, a badge might be awarded for completing an insurance literacy quiz, encouraging continued interaction with the platform.

Case Study: State Farm’s Drive Safe & Save

State Farm’s “Drive Safe & Save” program uses gamification to encourage safe driving. Customers install a telematics device in their vehicle to track driving habits. Safe driving behaviors are rewarded with insurance premium discounts, effectively using gamification to reduce risks and enhance customer engagement.

Examples from Insurers

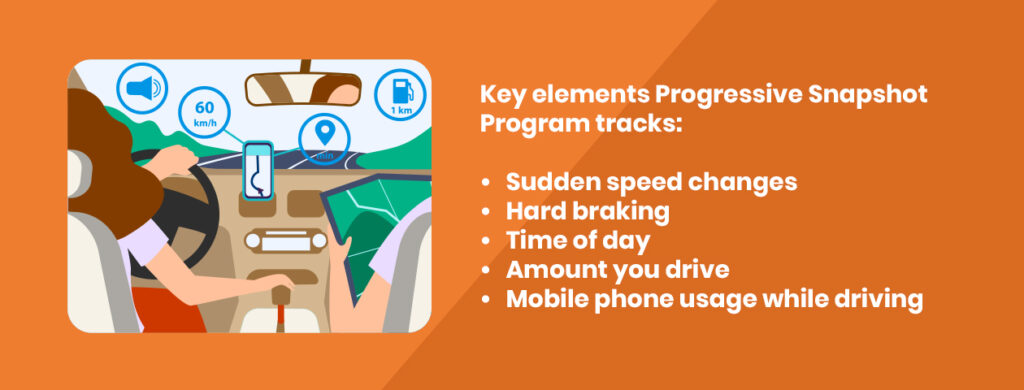

Progressive Insurance: Snapshot Program

Progressive Insurance offers the Snapshot personal driving tool, which personalizes your rate based on how you drive. The use of real-time driving data encourages safer driving behaviors, with the added gamification element of earning rewards for safe driving, such as discounts on premiums. This program not only helps in reducing claims but also actively engages customers by letting them track their driving habits and improvements over time.

UnitedHealthcare: Motion Program

UnitedHealthcare has rolled out the Motion program, which provides wearable technology to track the steps of its policyholders. Participants can earn up to $1,000 per year by meeting daily walking goals. This not only encourages a healthier lifestyle but also integrates a fun and competitive way to engage policyholders, reducing potential health insurance claims and increasing loyalty.

Incorporating Gamification into Marketing Strategies

Segment and Personalize for Better Engagement

Understanding your customer base allows for more targeted and effective gamification. For example, younger policyholders might be more receptive to mobile app-based games that offer social media integrations, while older customers might prefer web-based quizzes with straightforward rewards.

Interactive Marketing Strategies: A Case in Point

An interactive quiz on common insurance scenarios can educate customers about when to file a claim, what is covered under their policy, and how premiums are calculated. This not only boosts engagement but also empowers customers with valuable knowledge, potentially reducing future claims disputes.

Gamification Strategies for Insurance: Bridging the Gap

By implementing diverse gamification strategies, insurers can cater to various customer needs and preferences, significantly enhancing the overall user experience. These strategies ensure that customers are not only well-informed about their policies but are also more likely to remain engaged with the insurer over time.

The Benefits of Insurance Gamification

Improved Customer Loyalty and Retention

Gamification increases customer retention rates by making the insurance experience more engaging and enjoyable. This improved engagement reduces churn rates and fosters loyalty—a key metric in the competitive insurance landscape.

Enhanced Brand Differentiation

Gamification can help insurers stand out in a crowded market. By offering a unique, interactive experience, companies can differentiate their brand from competitors, attracting new customers and retaining existing ones.

Data Collection and Analysis

Interactive games and challenges allow insurers to collect data on customer preferences and behaviors. This data can be invaluable for refining marketing strategies and improving product offerings.

Are you ready to transform your insurance marketing strategy? At Insurance Inbound, we specialize in digital marketing that boosts engagement and wins new customers. Let us help you design a digital strategy that resonates with your target audience and sets you apart from the competition. Contact us to learn more about our services and how we can assist you in achieving your marketing goals.

By leveraging the power of gamification, insurance companies can not only enhance customer engagement but also gain a significant competitive edge in the industry. Remember, in the game of insurance marketing, engagement is key to winning customers and driving growth. Let Insurance Inbound be your partner in this journey toward enhanced customer engagement and market leadership.