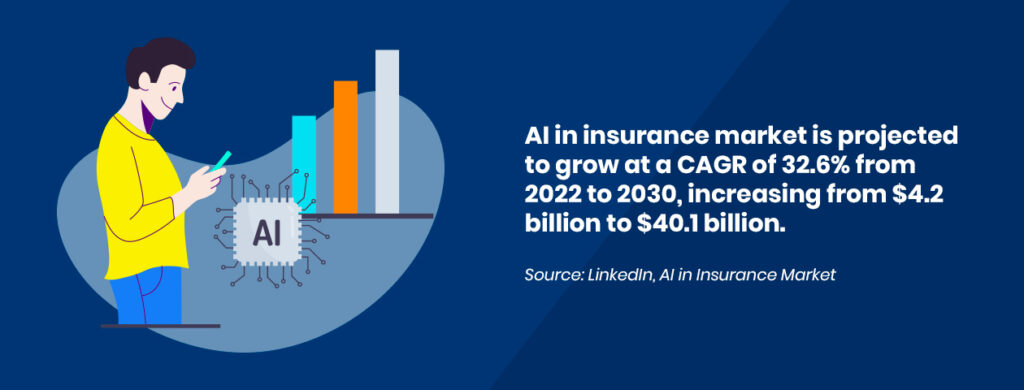

The insurance industry is on the brink of a revolution, thanks to advancements in AI and Machine Learning (ML). These technologies are transforming how companies interact with customers, streamline operations, and maximize conversions. This blog explores how AI and ML are reshaping personalized insurance marketing and why insurers must embrace this digital transformation.

Understanding the Impact of AI and ML in Insurance

AI and ML are not just buzzwords; they are powerful tools that insurance companies are using to innovate and improve customer engagement and satisfaction. AI helps in analyzing massive amounts of data to derive insights that power personalized marketing strategies, leading to improved customer engagement and higher conversion rates.

Personalized Product Development

Using AI, insurers can offer personalized policies tailored to individual needs. For instance, auto insurance premiums can be adjusted based on personal driving behavior, or home insurance can be customized based on a house’s security features and location. This level of customization not only improves customer satisfaction but also enhances risk management.

Enhanced Customer Interaction

AI enables insurers to interact with their customers more effectively. Through AI-driven chatbots and personalized messaging, companies can provide 24/7 customer service that is not only responsive but also personal. This technology makes it possible to handle customer queries swiftly and efficiently, thereby improving overall user experience. A study from Accenture reveals that 80% of insurance customers are seeking personalized offers, which significantly influences their loyalty and satisfaction levels. Additionally, AI-driven chatbots designed by companies like InsureBot have been able to handle over 50,000 customer interactions monthly, with a 35% increase in customer satisfaction due to personalized and swift query handling.

Real-World Applications of AI in Insurance

Dynamic Pricing and Real-Time Decisions

One of the most groundbreaking applications of AI in insurance is in the area of dynamic pricing models. According to McKinsey, real-time data-driven decision-making in insurance can enhance profitability by up to 21% by precisely adjusting premiums and minimizing risk exposure. These models use real-time data to adjust prices according to an individual’s behavior and changing risk factors. For example, usage-based insurance (UBI) products adjust premiums based on actual driving patterns rather than static historical data. Progressive Insurance uses telematics data from their Snapshot program to adjust premiums based on actual driving behavior, reportedly saving their customers an average of $145 per year.

Claims Processing Automation

AI has dramatically improved the efficiency of claims processing. AI enhancements in claims processing have reportedly increased processing speed by 40%, according to a report from Deloitte. By automating the initial steps of the claims process, insurers can reduce processing time from days to minutes. Advanced algorithms support the automation of routine tasks, allowing human agents to focus on more complex cases. Zurich Insurance implemented AI to automate damage evaluation for auto insurance claims, reducing the claim processing time from one week to a few hours.

Fraud Detection and Prevention

The Coalition Against Insurance Fraud estimates that AI-driven fraud detection tools save the insurance industry $300 million annually by identifying fraudulent claims more efficiently. ML models excel in identifying patterns that may indicate fraudulent activity. By analyzing past claims data, ML can flag claims that deviate from the norm, thereby enabling insurers to investigate these cases proactively. Aetna uses sophisticated algorithms to analyze patterns in claim submissions, which has helped them reduce fraudulent claims by 15% year-over-year.

Benefits of AI and ML in Personalized Insurance Marketing

Improved Operational Efficiency

AI and ML streamline operations, making them more efficient and less prone to error. Automated data processing reduces the need for manual input, which decreases the likelihood of mistakes and speeds up the entire insurance lifecycle from quote to claim.

Higher Customer Retention

By personalizing marketing efforts and customizing insurance products, AI and ML help insurers meet customers’ specific needs, which enhances customer loyalty and retention. A survey by EY found that personalization in insurance policies increases customer retention rates by up to 28 percent. Personalized interactions based on AI analysis of customer data can make customers feel valued and understood, leading to higher satisfaction rates. State Farm offers personalized home insurance discounts based on security systems and smoke detectors installed in the home, which has increased their customer retention rates.

Increased Conversion Rates

Personalized marketing strategies powered by AI lead to higher conversion rates. HubSpot reports that personalized calls to action result in a 42% higher conversion rate than generic calls to action. AI’s ability to analyze vast amounts of data and predict customer behavior allows insurers to target the right customers with the right messages at the right time. Liberty Mutual’s customized ads based on user behavior and preferences have seen a 38% increase in conversions.

Challenges and Considerations

While AI and ML offer numerous benefits, there are challenges to consider, such as data privacy issues and the need for continuous learning and adaptation of models to reflect new data and changing conditions. Insurers must also address the ethical implications of AI decisions and strive to maintain transparency in AI-driven processes.

As we look towards the future, it is clear that AI and ML will continue to play a pivotal role in shaping the insurance industry. For insurance marketers, the message is clear: leverage the power of AI and ML to deliver more personalized, efficient, and engaging customer experiences.

Interested in transforming your insurance marketing strategies with AI? Contact Insurance Inbound, your dedicated insurance digital marketing agency, to learn how we can help you harness the power of AI for better customer engagement and higher conversions. Contact Insurance Inbound to get started!